stock dollar cost average calculator

How to Calculate the Dollar. If the stock price recovers to the 1st purchase price of 5000 the total value of the investment will.

Lump Sum Calculator Investing Now Vs Later With Dollar Cost Averaging

Dollar cost averaging is an investment strategy whereby the investor contributes a fixed amount of cash into his portfolio and purchases shares in an asset at fixed times.

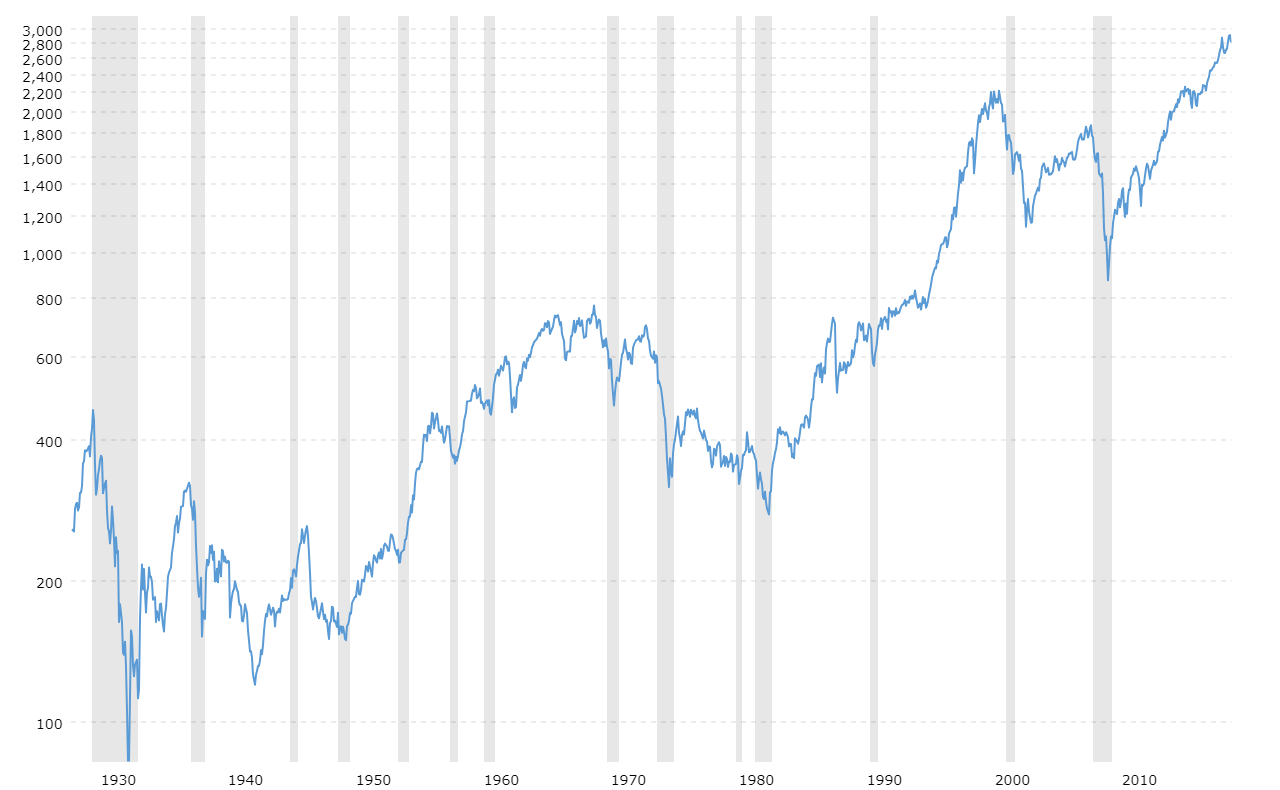

. Dollar cost averaging DCA is an investment strategy where you invest a fixed amount of dollars over a given period at multiple intervals. Dollar Cost Averaging for Vanguard SP 500 ETF by investing 10000 on a bi-weekly basis generated a cumulative return of -1326 from 2020-Oct-24. The investor purchases more.

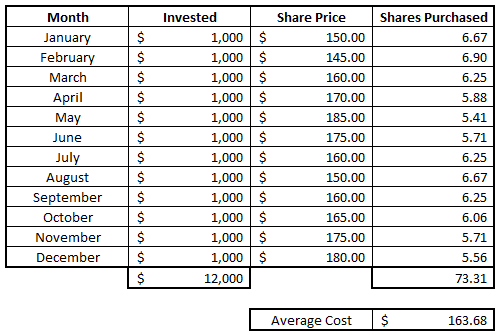

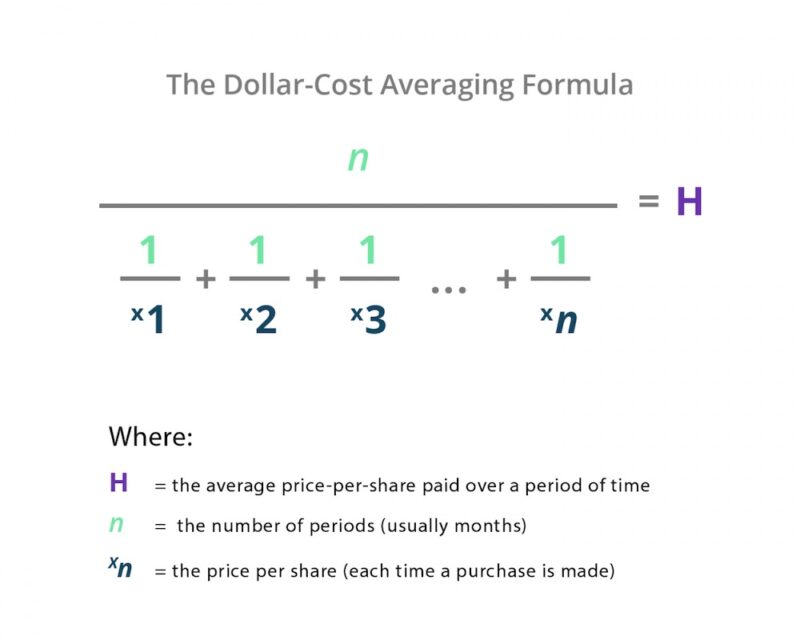

Simply add the number of shares and the average Buying or the total cost. DCA is calculated by dividing the total sum invested by the total shares bought eg. Backtest dollar-cost averaged investments one-month intervals for any stock exchange-traded fund ETF and mutual fund listed on a major US.

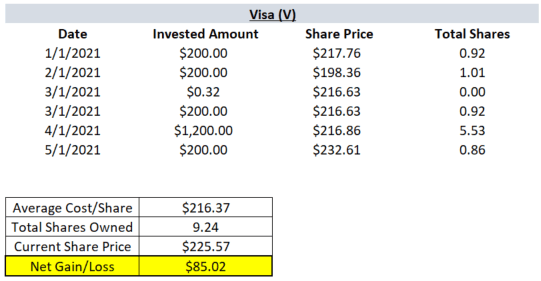

Underlying SPDR SP 500 ETF etf returned 1342 over the same period with bi-weekly returns averaging 031. If you buy a stock multiple times and want to calculate the average price that you paid for the stock the average down calculator will do just that. Dollar Cost Averaging DCA is an investment strategy in which you set aside a fixed amount every month or every year to invest into a chosen asset.

Dollar Cost Averaging for Apple Inc. Total number of contracts. This calculator can use data dating back to the first trading month of 2010 June so it.

Dollar cost averaging DCA is an investment strategy in which an investor invests a fixed amount at regular intervals regardless of the share price. Stocks Under 1 2 5 10. Our stock average calculator works.

Using the average down calculator the user can calculate the stocks average price if the investor bought the stock differently and with other costs and share amounts. See how your blended Dollar Cost Averaged Price evolves from 2020-Oct-26. Market price returns are based on the prior-day closing market price which is the average of the midpoint bid-ask prices at 4 pm.

On this page you will find the dollar-cost averaging calculator for Tesla Inc TSLA stock. Dollar Cost Averaging for SPDR SP 500 ETF by investing 10000 on a bi-weekly basis generated a cumulative return of -653 from 2020-Oct-26. You bought 100 shares last week at the price of 2 for a single share when this week the price dropped to.

To calculate the average price you need to know the total contracts shares quantity and the purchase price of each contract share. Market price returns do not represent the returns an investor would receive if shares were traded at other times. Volume 0 300000 500000.

Add a minimum of two. By investing 10000 on a bi-weekly basis generated a cumulative return of -322 from 2020-Oct-24. Calculating your dollar cost average into an investment is a pretty simple formula.

Returns include fees and applicable loads. First you enter the number of shares purchased and their price at the time of purchase and the stock average calculator using the formula in the Stock. This tool enables you to calculate profitslosses based on this strategy.

Dollar Average Price Number of periods 1Share Price on investment dates This formula would help to calculate the Dollar-cost average in an easy way by just filling in the required. As the stock market. Dollar-cost averaging DCA is an investment technique of buying a fixed dollar amount of a particular investment on a regular schedule regardless of the share price.

Online dollar cost average calculator DCA calculator helps you to find the average cost. This changes the cost basis from 5000 to 3000 which is a difference 2000 or 4000. Youre simply taking the total investment cost and dividing it by the total amount of shares that.

An example of this would be to invest 100 every.

Dollar Cost Averaging A Passive Stock Investment Strategy Youtube

Dollar Cost Average Calculator Returns Nerd Counter

Dollar Cost Averaging 101 Weekly Market Viewpoint 9 17 21 Ally

A Free Calculator To Help You Calculate Your Dollar Cost Average Investments

Dollar Cost Averaging Versus Lump Sum Investing My Own Advisor

How Can I Calculate Average Cost For My Investments

A Free Calculator To Help You Calculate Your Dollar Cost Average Investments

What Is Dollar Cost Averaging Take The Emotion Out Of Investing Genymoney Ca

How To Average Stock Price Calculator Lifescienceglobal Com

How Often Should I Invest Pearler

Dollar Cost Averaging Formula Meaning Investinganswers

Dollar Cost Averaging Calculator

What Is Dollar Cost Averaging Forbes Advisor

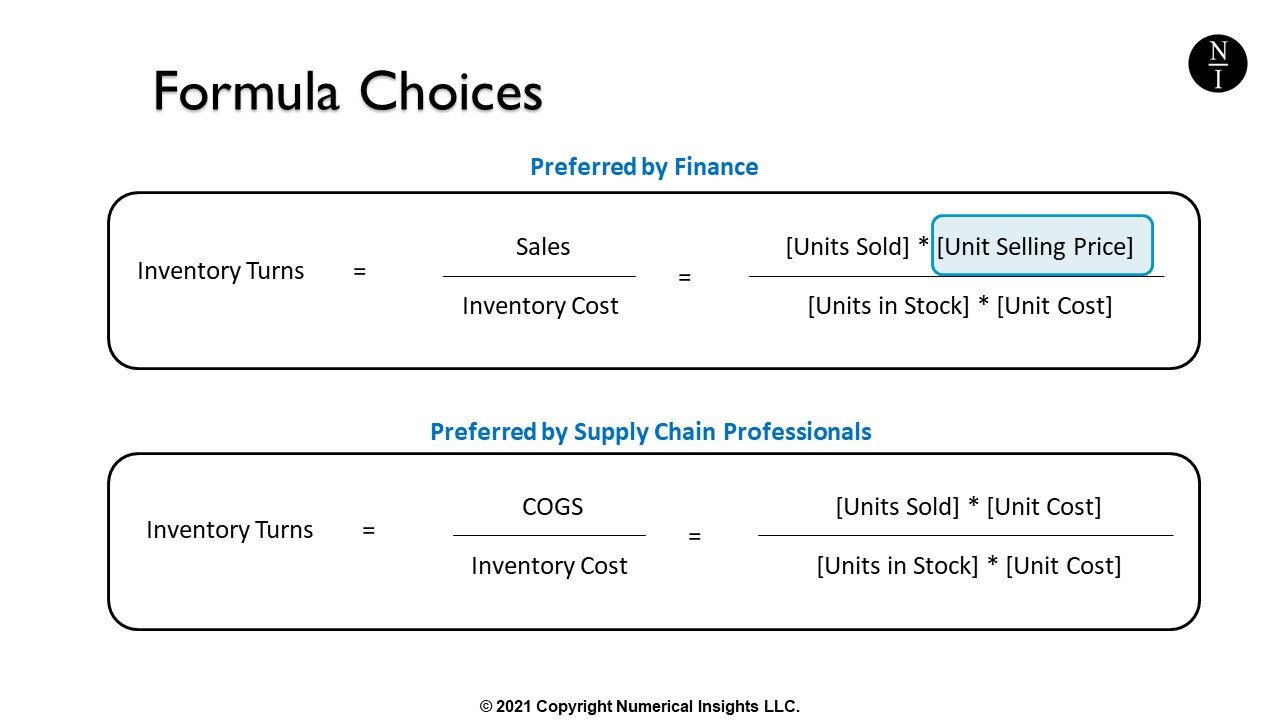

Formula To Calculate Inventory Turns Inventory Turnover Rate

Dollar Cost Averaging How It Works And When It Pays Off 2020 Analysis

Value Averaging Spreadsheet Aaii

Guide To Calculating Cost Basis Novel Investor

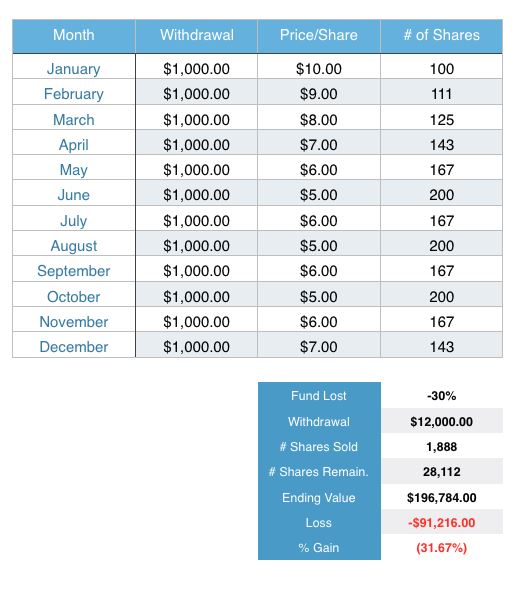

Dollar Cost Averaging And Reverse Dollar Cost Averaging Robert Gordon Associates Inc